FOR BUSINESs OWNERS & EMPLOYEES

There are many factors that could unexpectedly impact your business, our wealth management advice and financial advisors help businesses to manage and protect their assets, employees and their income for a more secure future.

OUR SERVICES

reveal more

Whatever the nature of your business, we can help you find the most accurate and effective insurance and protection.

reveal more

Make sure your business is prepared for cases where an employee is unable to work due to a long-term injury or illness, we can help you establish Group Income Protection to ensure you have financial protection and support.

reveal more

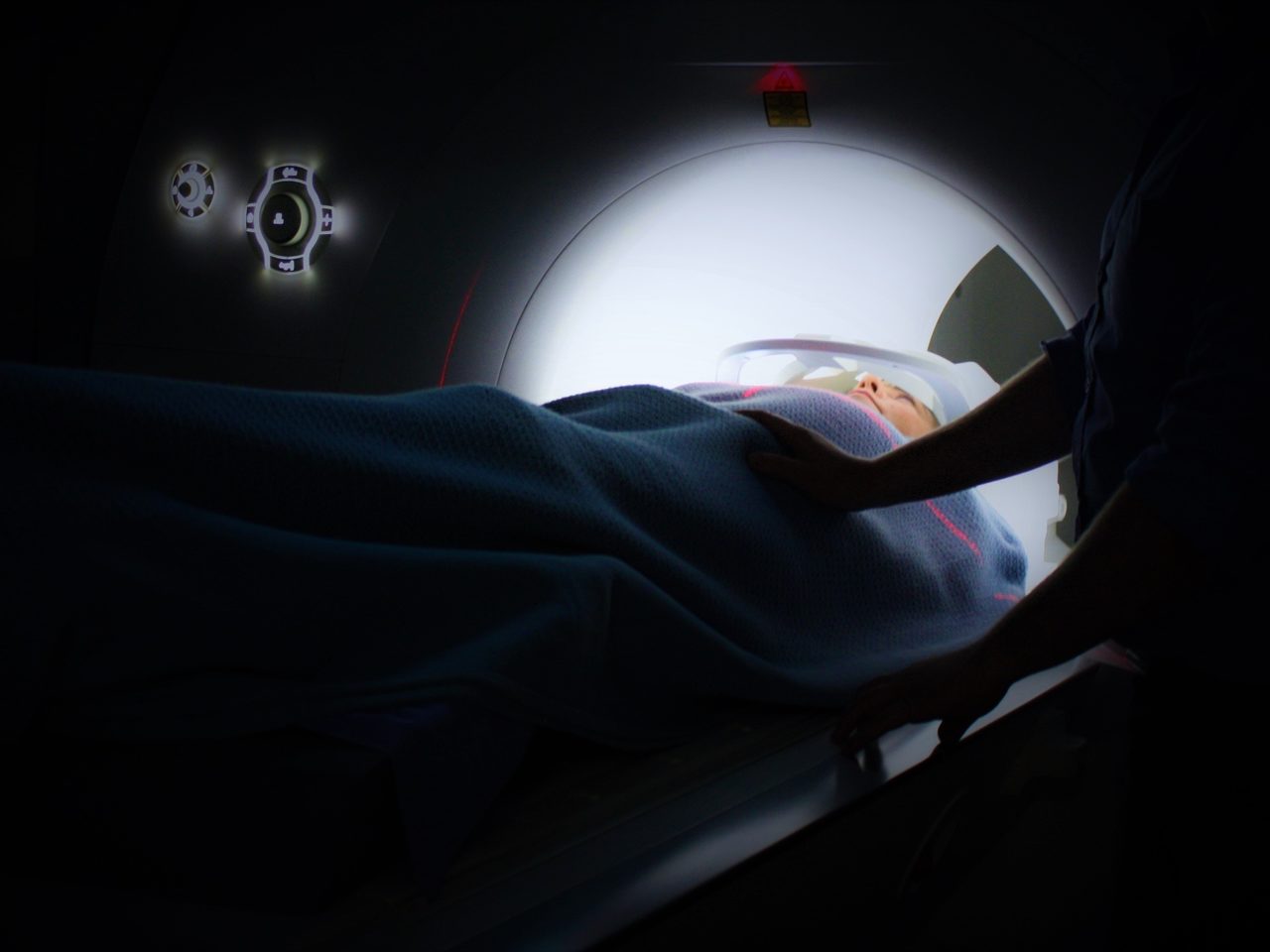

Adding Group Private Medical Insurance to your business can be a valuable asset when it comes to providing both confidence and peace of mind to your existing workforce and of course, be a great recruitment tool when hiring new talent. We help you find a solution that will be beneficial to both your business and your employees.

reveal more

There are a lot of regulations and laws surrounding workplace pensions, we make it simple to ensure that your business has a pension plan in place that meets all statutory requirements.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

reveal more

It is a great idea for your company to offer protection to employees should they or their families experience a critical illness. We can help you find a solution that will equally benefit you, your business and your employees, so everyone can have peace of mind.

reveal more

We make it simple and easy to find the right Trustee Investment Planning for your business, providing a wide range of investment options to help you grow over a medium to long-term period.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

reveal more

Get accurate advice on tax requirements for your business, personalised entirely to the specific needs of your individual situation.

The levels and bases of taxation and reliefs from taxation can change at any time. The value of any tax relief depends on individual circumstances.

reveal more

If you are looking to grow your business, we provide personalised advice designed to help you navigate a range of commercial and corporate investment solutions, to help you achieve your next strategic objectives.

The value of an investment with St. James’s Place will be directly linked to the performance of the funds you select and the value can therefore go down as well as up. You may get back less than you invested.

reveal more

Whether you have decided it's time to plan your exit strategy or you just want to be prepared, we help you explore your options and get the ground running on the best plan for you and your business.

Exit strategies may involve the referral to a service that is separate and distinct to those offered by St. James's Place.

OUR VALUES, YOUR PEACE OF MIND

We make sure that our interests are always aligned with those of clients’ in selecting investment strategies for them. While some advisors are compelled to generate transactions, we focus on providing the best advice to our clients.

We take pride in being specialists in ethical and sustainable financial advice. We are dedicated towards holding people who want to manage their finances with the utmost efficiency & responsibility Whatever we do, we do it with ethics.

We, at John Purnell Wealth Management, pride ourselves in our extensive knowledge. Our financial management expertise is what makes us stand out of the crowd. We are adept at providing advice and guidance on complex technical issues.

Jon Purnell Wealth Management is experienced in creating bespoke financial solutions to suit a wide variety of circumstances, so that all advice, services and products are tailored to the individual needs of the client.

As a St. James's Place appointed Representative, St. James's Place guarantees the suitability of the advice given by members of the St. James's Place Partnership when recommending any of the wealth management products and services available from companies in the Group, more details of which are set out on the Group's website here.

Ease the worry around long-term care by gaining expert advice on planning and managing the financial aspects, helping you cover costs with peace of mind while protecting your assets and inheritance. This may involve a referral to Karehero, a comparison and care matching provider, whose services are separate and distinct to those offered by St. James's Place.

TAKE CONTROL OF YOUR FINANCIAL FUTURE

Planning for your future is essential, and having the right tools to guide your decisions can make all the difference. The St James's Place Retirement and Inheritance Tax (IHT) Planning Calculators provide you with easy-to-use, practical tools to help you better understand and manage your financial goals. Whether you're looking to ensure a comfortable retirement or reduce the impact of IHT on your estate, these calculators are designed to give you a clear picture of your financial situation and help you make informed decisions that align with your long-term objectives.

Retirement Calculator

Our Retirement Calculator is designed to help you plan for a secure and comfortable retirement. By inputting your current savings, income, and retirement goals, the calculator will provide an estimate of how much you need to save to achieve your desired lifestyle in retirement. It takes into account factors like inflation, investment growth, and life expectancy to give you a realistic view of what you can expect in the future. Whether you're starting early or nearing retirement, this tool is an essential resource for making smart financial decisions.

IHT Planning Calculator

The Inheritance Tax (IHT) Planning Calculator helps you assess how much IHT your estate could be liable for and provides insights into ways you can reduce your exposure. By entering information about your assets and beneficiaries, the calculator gives you an estimate of the potential IHT liability your estate may face upon your passing. It also offers suggestions on strategies to mitigate the impact, such as gifting, trusts, and other estate planning options. This tool is invaluable for anyone looking to protect their wealth and ensure more of it is passed on to loved ones.

LATEST FEEDBACK

The reviews shown above have been gathered and displayed directly through Google and have not been verified by SJP.

Their major role is to create strategies for eliminating financial risks and building wealth over the long term. They can help you create a game plan that puts you on track to achieve your financial goals.

Having a large sum of money is not necessary when it comes to taking our financial advice. However, the larger the amount is, the more important it is to get it right. When you are nearing retirement, it is crucial that you take advice, irrespective of the sum of money you have.

This is coming from one of the most trusted pension advisers. It is a type of retirement plan that provides you with monthly income after you retire from your position. This magical gift from the environment will help you save money along with reaping a lot of benefits.

Yes, of course. A financial planner can help you organize your finances to improve your future financial outlook. They will first help you determine your financial goals and then come up with a strategy to help you achieve them based on your needs.

No pension advisor near you can give you a definite answer. This depends on a plethora of factors. Mainly, it depends on how much you have put in and how well it has performed. It also depends on what age you are when you take benefits. The best you can do at the stage of retirement is seek advice from the best.

GET your 2025 FInancial REVIEW

Did you know that your accountant may hold the key to a quicker and more comfortable retirement for you? Nowadays accountants work hand in glove to not only help their clients run successful businesses but, with the right financial expertise, can also help a business owner to better capitalise and design a better retirement too.

Jon Purnell works with many accountancy professionals to do just that. So, regardless of what stage you are at within your business, Jon Purnell would like to help you beat the curve sooner. Put us in touch today!

Please speak to our team today and claim your 2025 financial review.

Book a no-obligation call with Jon Purnell Wealth Management to discover how we can help you make the most of your money and financial opportunities.

REGARDLESS OF YOUR CIRCUMSTANCES, WE WOULD LOVE TO HEAR FROM YOU